The rapid growth of digitalization in Africa, the rising need for cloud adoption to power today’s business operations, the AI revolution, and the increasing urgency of cybersecurity are global trends that are shaping the future of companies in Kenya. International IT trends certainly influence the Kenyan market, but local realities are giving the country’s digital transformation a unique trajectory.

Kenya is experiencing its own localized tech dynamics driven by the fast-growing roles of FinTech, e-commerce, and startups in driving innovation and stricter compliance with data protection laws, such as the Data Protection Act. The growth of small and medium-sized enterprises, the high IT infrastructure scaling costs, and the pressure to optimize technology investments have combined to shape Kenya’s unique trajectory towards digital growth and maturity.

From startups in Nairobi’s innovation hubs to long-established companies, businesses across the country are undergoing profound shifts in how they view technology. Kenyan companies now recognize that a robust IT infrastructure isn’t just nice to have—it’s the backbone of sustainable business growth and success.

Within this context, Servercore, an IT infrastructure provider with a strong presence in Kenya (including a dedicated cloud region in Nairobi), conducted a survey to capture the pulse of the country’s IT ecosystem. The findings highlight how Kenyan companies are reassessing their technology priorities and refining infrastructure strategies to remain competitive in a fast-changing, digital, and dynamic landscape.

The Roles, Industries, and Insights

Survey respondents provided useful insights into the state of the Kenyan IT ecosystem and infrastructure trends. 91.7% of the 109 participants work directly in the Kenyan market, ensuring the findings reflect real-world conditions, rather than theoretical assumptions. In particular, the respondents comprised a balanced mix of business and technical decision makers, including CEOs and company owners (15.6%), developers (15.6%), team leads and technical managers (12.8%), and a range of other IT professionals.

The participants were presented by microenterprises (33.0%) and small businesses (22.9%), medium firms (17.4%) and individual practitioners (12.8%). This highlights the dominance of ‘small business’ players in the country’s business environment and explains a strong emphasis on cost optimization, scalability, and outsourced IT services rather than large-scale in-house IT development.

Within the Kenyan technology sector, IT integrators (31.2%) had the highest representation, followed by FinTech (16.5%), cybersecurity firms (8.3%), and retail technology providers (7.3%). Moreover, 1 out of 4 (23.9%) respondents occupy decision-making roles, ensuring that the survey captures not only industry observations but also reflects genuine business intentions and strategic direction across the country’s digital landscape.

Aggressive Plans for Scaling IT Infrastructure

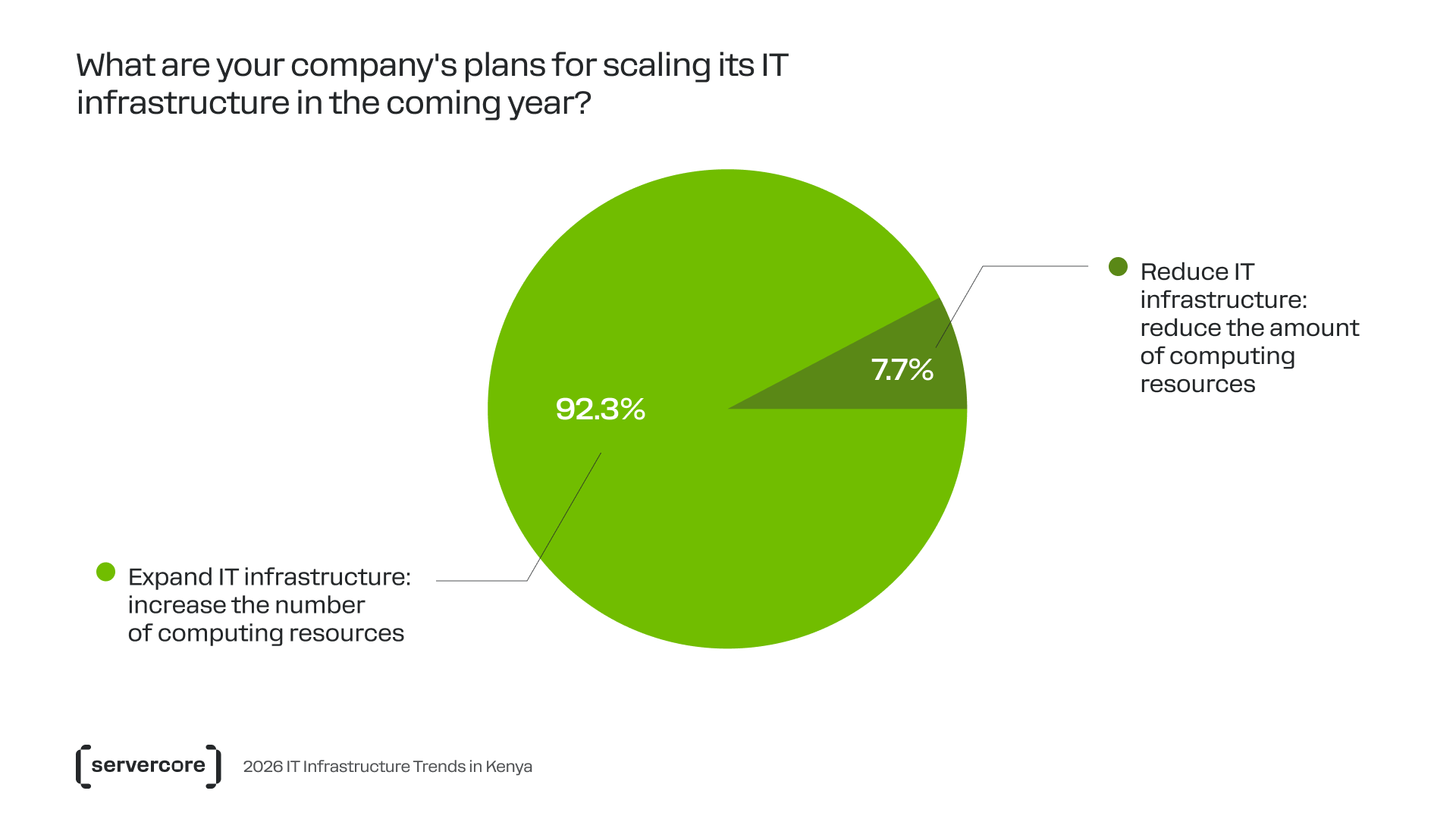

The appetite for IT infrastructure investment among Kenyan companies is strong and impressive. Kenyan businesses are setting bold targets for IT infrastructure growth. An overwhelming 92.3% plan to scale their IT infrastructure in the coming year. Only 7.7% project reductions, signaling a strong, market-wide consensus that technology capacity is critical to future business success.

But there’s a deliberate strategy guiding this expansion. Kenyan firms are not about pursuing growth blindly, they are aligning technology investments with operational needs and financial realities. This POS-based SME refined its IT infrastructure, achieving a 60% reduction in IT costs and more efficient service delivery.

The focus is on sustainable, scalable IT infrastructure solutions that can adapt to shifting business demands while keeping costs under control. Such a perspective reflects a maturing view of IT infrastructure as a source of competitive advantage. IT is no longer regarded as a back-office expense, but a strategic driver of growth, customer satisfaction, and market expansion.

Kenyan businesses are investing in IT to stay ahead of the digital curve, supported by government initiatives such as the Kenya National Digital Masterplan 2022-2032 and the newly launched Artificial Intelligence Strategy (2025–2030), which aim to accelerate nationwide digital transformation and innovation.

92.3% of companies plan to expand their computing resources within the next year. Only 7.7% are planning reductions.

Changes in IT Infrastructure Investment

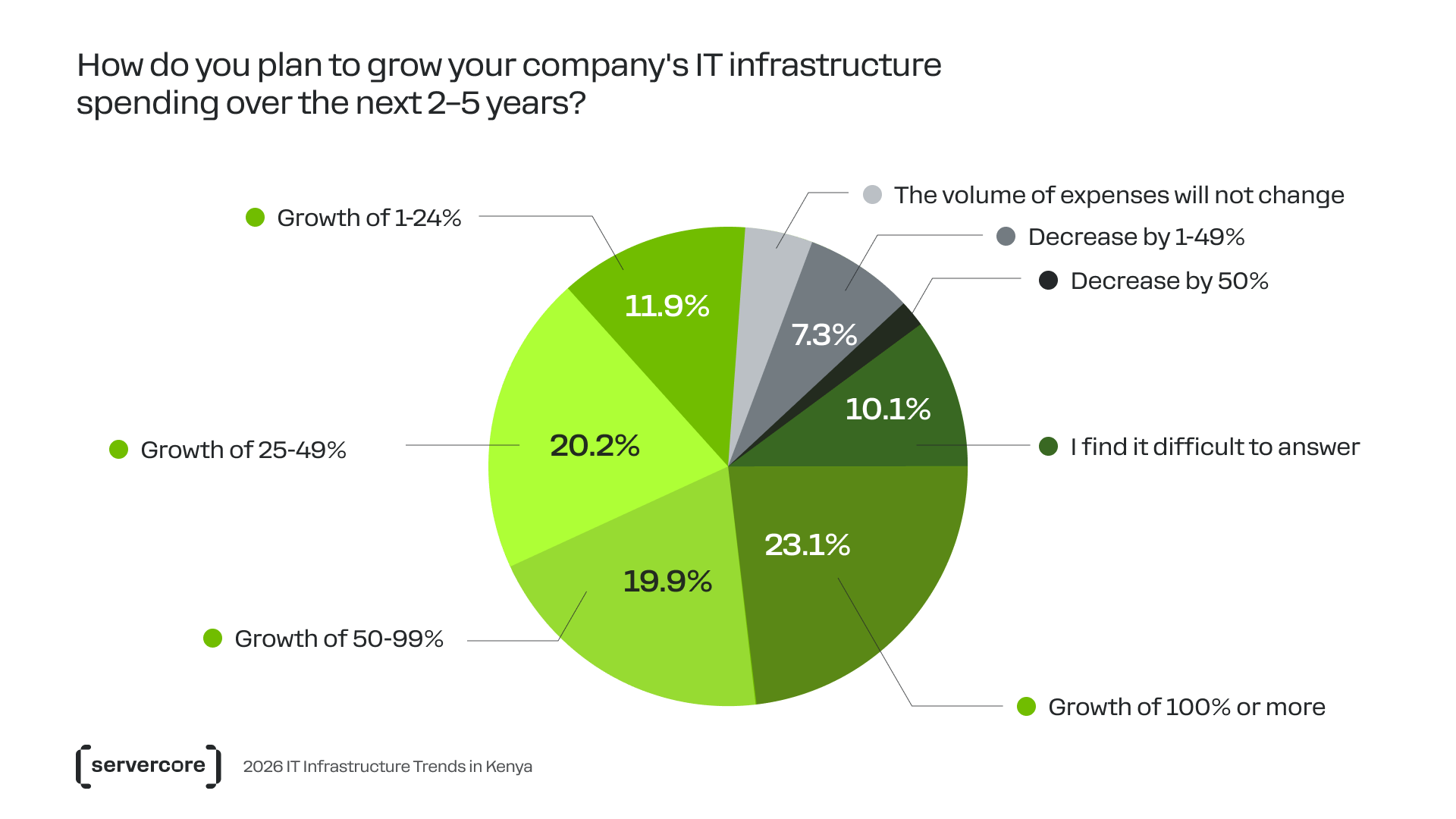

Overall, the findings showed that 76% of businesses are prepared to increase their IT infrastructure spending. Remarkably, 23.3% of companies are ready to increase their IT investments by 100%. The growth and driving forces in IT infrastructure investment mirror Kenya’s broader economic transformation.

Digitalization initiatives (37.5%) are driving much of the new infrastructure spending, as Kenyan businesses prioritize modernizing their operations to remain competitive. Growth is also being fueled by the rollout of new business projects (31.3%) and the steady expansion of modern consumer bases (28.1%), all of which are pushing companies to strengthen their technological capacity. Together, these factors demonstrate that technology spending is no longer optional but has become a strong pillar of business growth strategies nationwide.

75.1% of companies plan to increase their investments in IT infrastructure. 23.1% of companies plan to increase their spending by more than 100%.

The rise in infrastructure costs is linked to digitization (37.5%), the launch of new projects (31.3%), and an expanding customer base (28.1%)

Current Priorities in IT Infrastructure Development

Kenya’s current priorities in IT infrastructure development reflect a forward-looking position that combines modernization, innovation, and regulatory compliance in an effort to build a resilient digital economy and position the country as a leading technology hub on the continent.

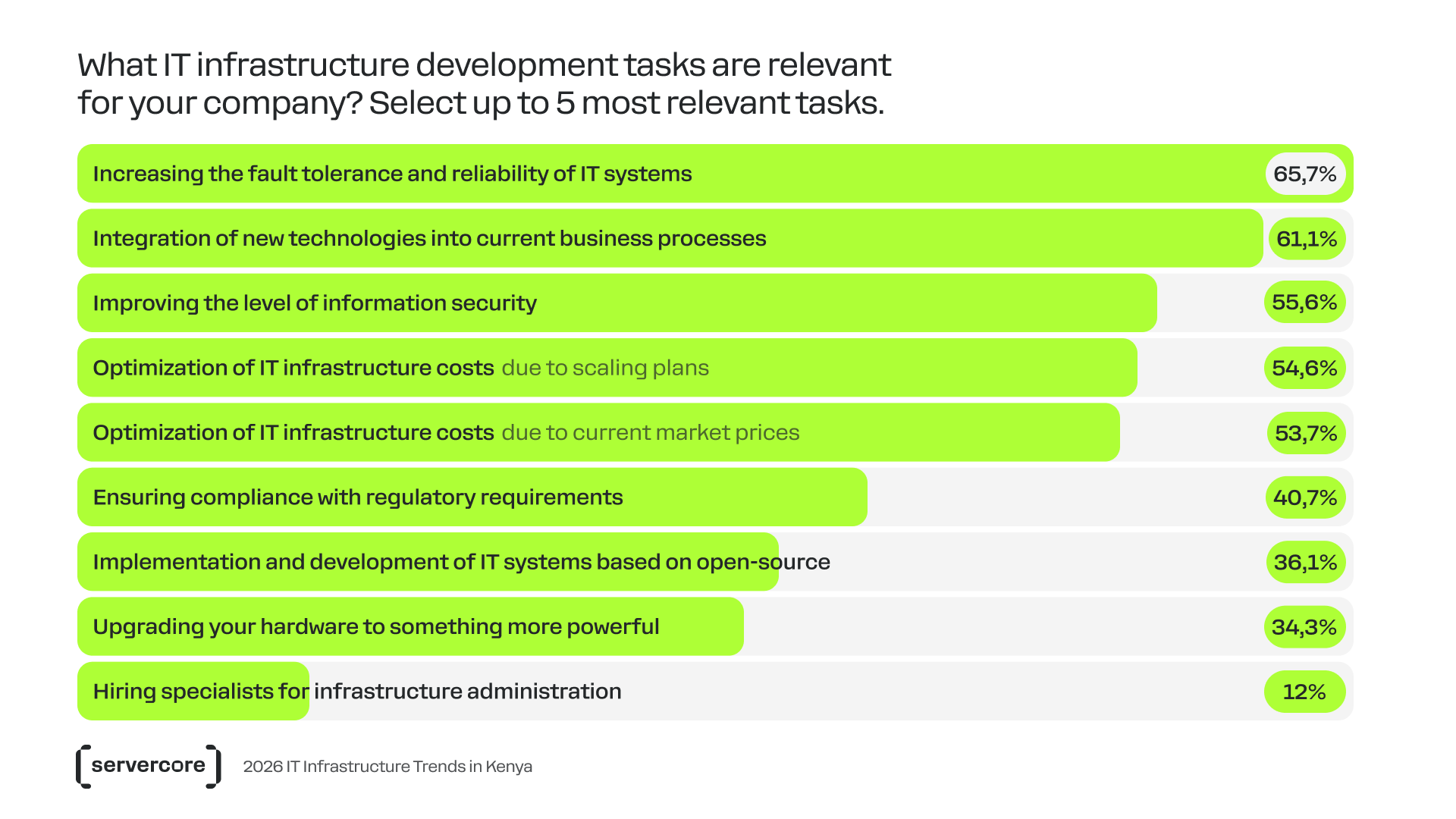

Kenyan companies have identified the following as their top technology priorities:

- Improving system resilience

- Integration of new technologies into business processes

- Enhancing information security

- Optimizing IT infrastructure costs

Local businesses are moving to the cloud for scalability, flexibility, security, and sector-specific IT frameworks. Digital skilling initiatives are progressively empowering SMEs and startups to deploy modern IT solutions. The growth of local and international data centers in Nairobi boosts hosting, disaster recovery, and storage capacity.

The Logical Connection:

As stated above, the first key insight is that 92% of companies want to scale their IT infrastructure (based on the second question). However, only 76% are ready to increase their IT spending in the coming years (from the first question). The gap is mainly due to the fact that most companies prioritize cost optimization (as indicated in the third question). At the same time, the top business priorities for the vast majority are data security and the integration of new technologies into business processes (also from the third question).

Despite this, companies show very little interest in hiring or developing in-house IT staff to support these infrastructure initiatives, which suggests a strong disposition to rely on IT infrastructure outsourcing, as revealed in the figure below.

Local vs. Global IT Infrastructure Hosting

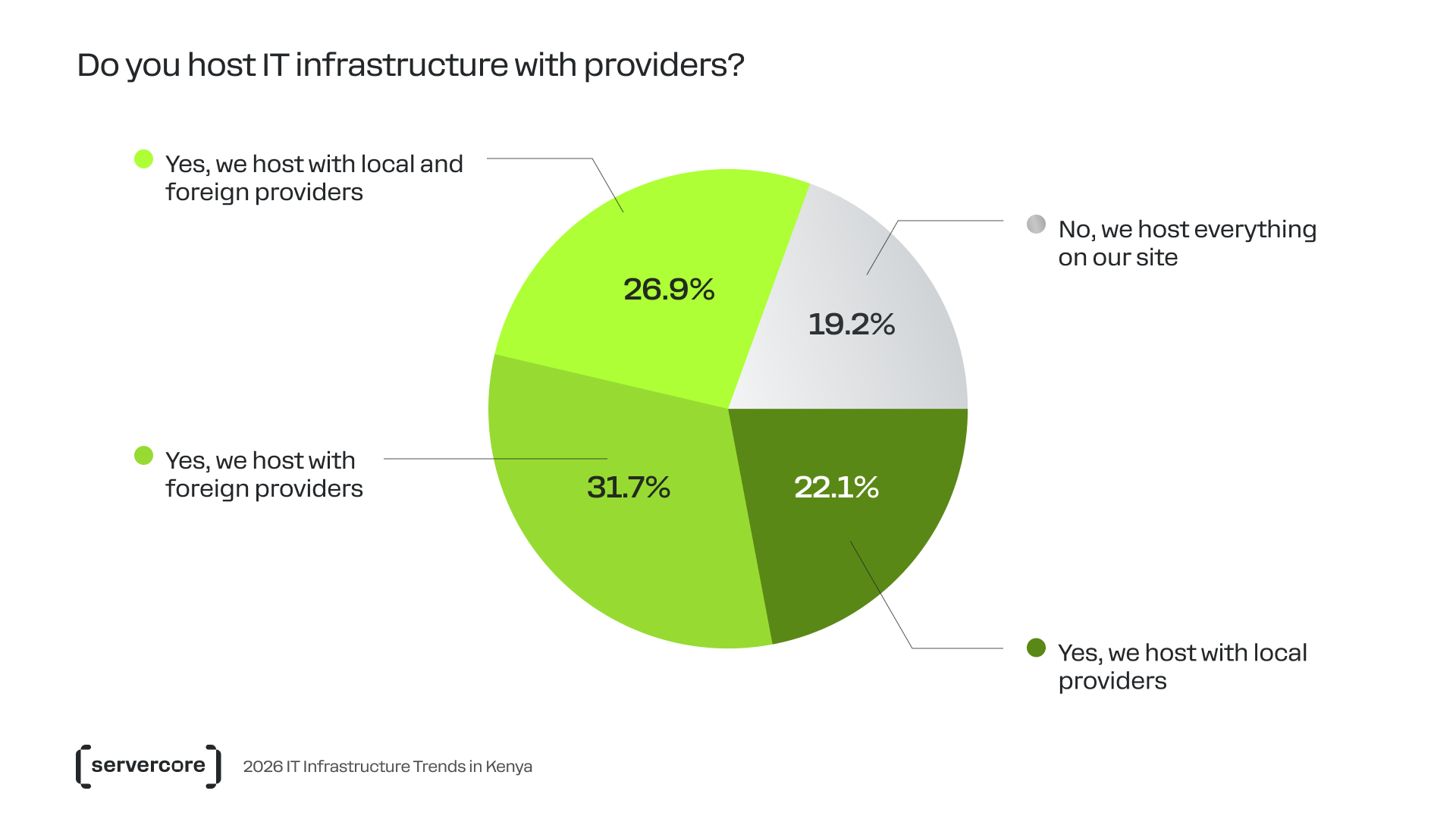

Kenyan companies show a preference for global IT infrastructure providers (31.7%). Meanwhile:

- 26.9% use a hybrid approach, hosting data with both global and local providers

- 19.2% do not use public clouds and rely on on-premise solutions

- 22.1% use only local providers

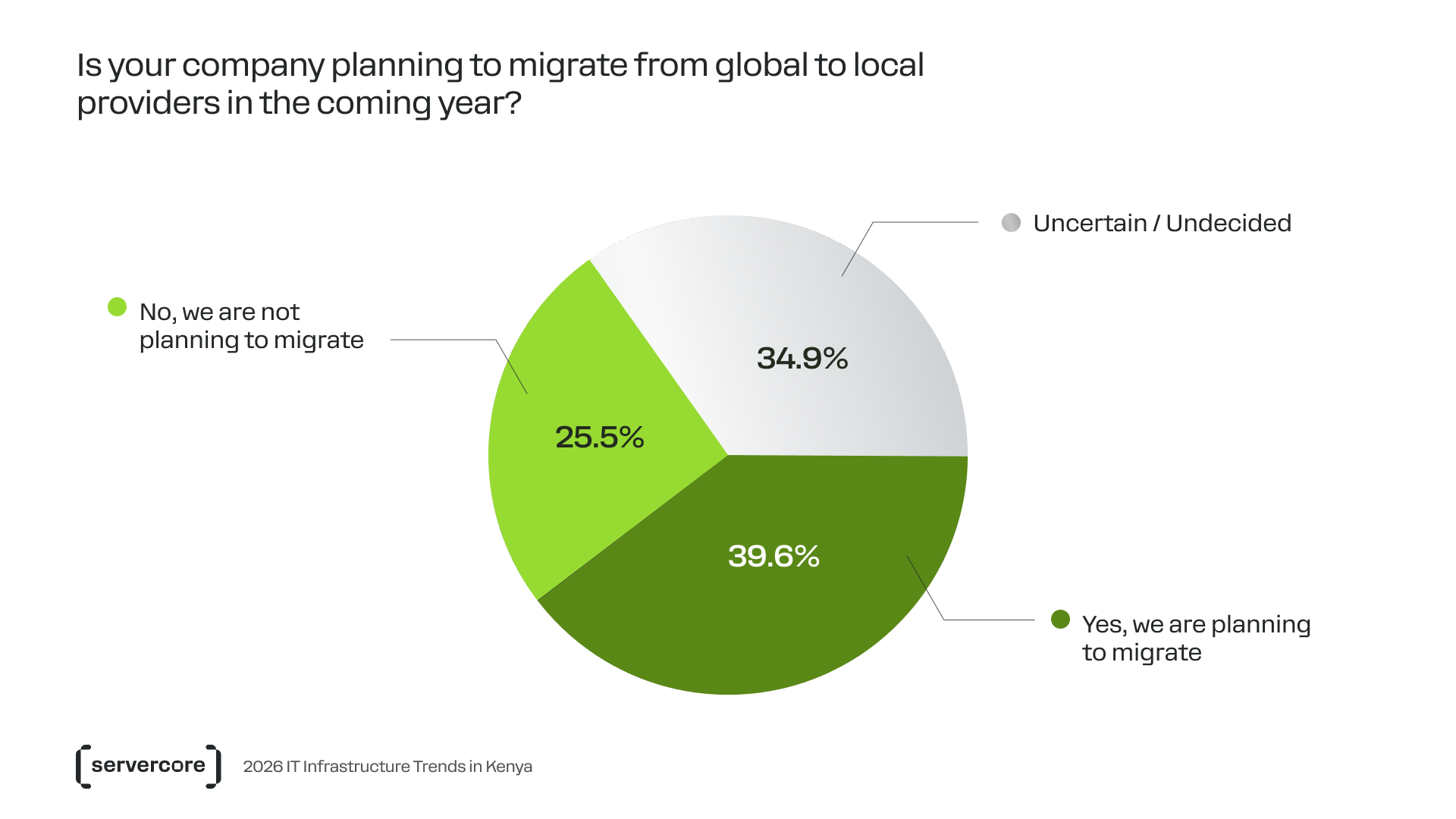

39.6% of the study respondents plan to migrate their infrastructure from global to locally registered providers in Kenya within the following year.

The demand is clear, and the move to local providers is only the start of a significant market transition.

The Drivers Behind Local Provider Adoption

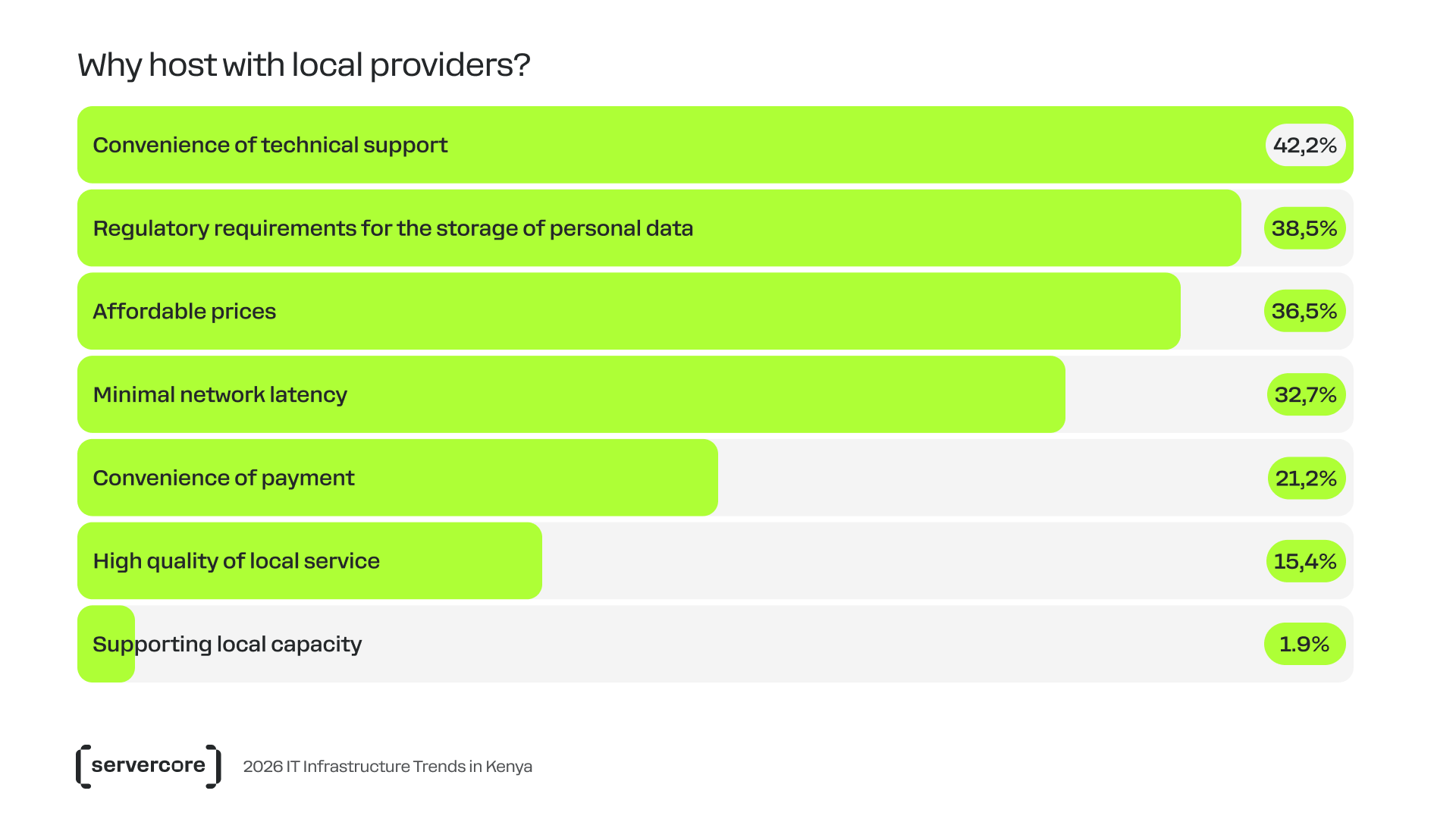

The factors influencing the choice of local infrastructure providers reveal the sophisticated decision-making processes that characterize Kenya’s maturing IT market. First, regulatory compliance, particularly adherence to the Data Protection Act (DPA), stands as the primary consideration for businesses partnering with local IT providers. This legislation has created both requirements and opportunities that favor local infrastructure solutions.

Second, competitive pricing is a crucial factor, as local providers often offer more attractive IT cost structures than international alternatives. This pricing advantage is significant for Kenya’s predominantly small and medium enterprise market, where cost optimization remains a key business priority.

Third, low network latency represents a key technical advantage offered by local providers, enhancing application performance and user experience for Kenyan businesses and their customers. The factor grows increasingly important as companies deploy more sophisticated, real-time applications that depend on rapid response times.

Lastly, convenient and responsive technical support is key selection criterion for Kneyan firms. Local providers often deliver more accessible, culturally aligned, and time-zone-appropriate support services, an advantage that’s very valuable for businesses that lack extensive in-house IT expertise. Besides, experienced IT specialists are a limited resource in the local market, meaning that even companies looking to build internal expertise struggle to find qualified and talented professionals. By partnering with local technology partners, companies gain access to technical skills, timely guidance, and reliable problem resolution, ensuring their business operations run smoothly, remaining stable and efficient.

Key Factors When Choosing a Local Provider

The main factors influencing the choice of a local provider are:

- Regulatory requirements for storing and processing personal data (DPA 2019)

- Competitive pricing

- Low network latency

- Convenient technical support

In Summary

Due to a mix of regulatory, financial, and technical advantages, many Kenyan companies are increasingly turning to local IT infrastructure providers.

Compliance with the Data Protection Act (DPA 2019) remains the leading driver, ensuring legal alignment and data sovereignty. Competitive pricing makes local provider options more attractive, especially for cost-sensitive SMEs. Additionally, low network latency enhances system performance and user experience, while accessible, locally aligned technical support provides faster, more personalized assistance.

Together, these factors highlight the growing sophistication of Kenya’s IT market and the strategic appeal of local providers.